2% Agent Commission Withholding Tax

|

.gif)

|

|

|

About 2% Agent Commission Withholding Tax

|

|

|

| A 2% Withholding Tax (WHT) will be imposed to agents, dealers or distributors whose commission exceed RM100k within 1 year. Besides, LHDN has deferred the remittance of WHT until 31.03.2022.

|

|

|

| According to the latest FAQ, the company has to email Form CP107D to LHDN before payment made and agents must have a tax number. We have compiled some FAQs about Withholding Tax, let’s take a look!

|

|

|

|

|

| For more information, leave your message to us now.

|

|

|

.png)

|

|

FAQ (Updated until July 2022):

|

| 1. What kind of income is subjected to WHT?

|

| All types of payments, such as commissions and incentives in the form of cash, arising from sales, transactions or programs made by the agents/wholesalers/suppliers.

|

|

|

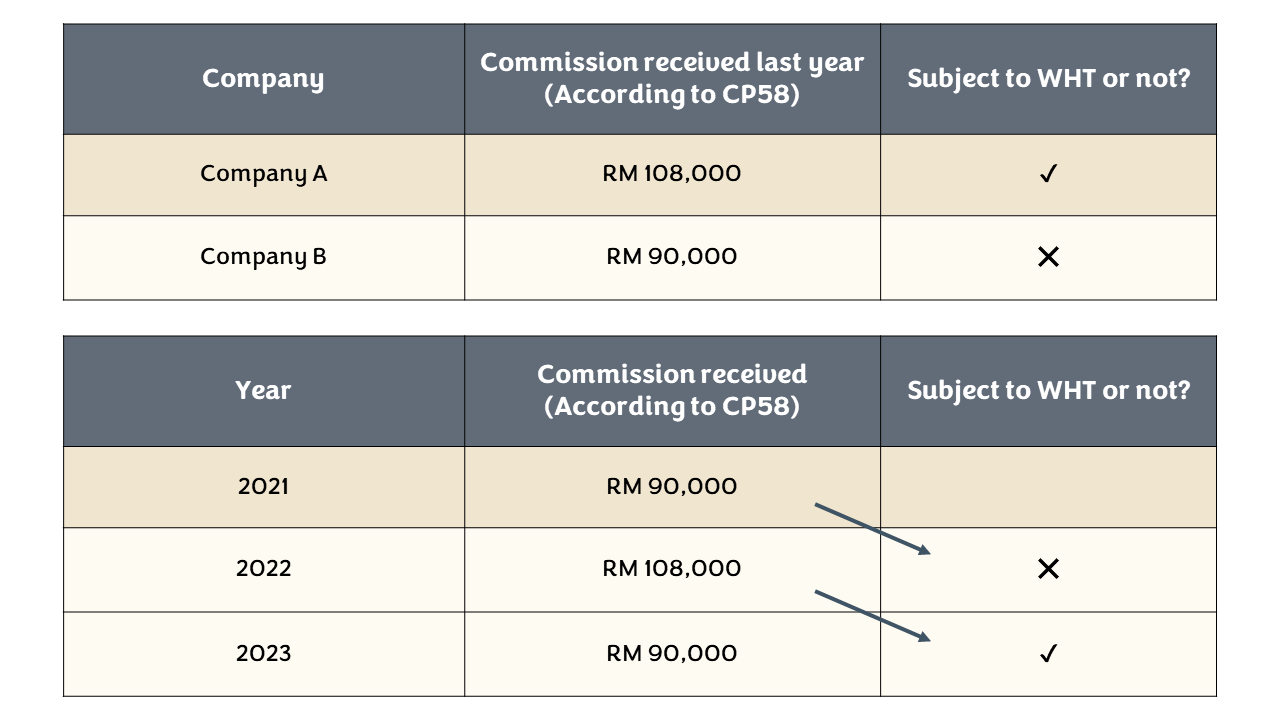

| 2. How is the RM100k threshold assessed?

|

- By company:

- Agent A received RM108k commission from Company A and RM90k commission from Company B last year. In this year, agent A need to contribute 2% WHT in Company A, but no need to contribute in Company B.

- By year:

- If Agent B reaches the RM100k threshold in 2022, he needs to contribute WHT in 2023.

|

|

|

|

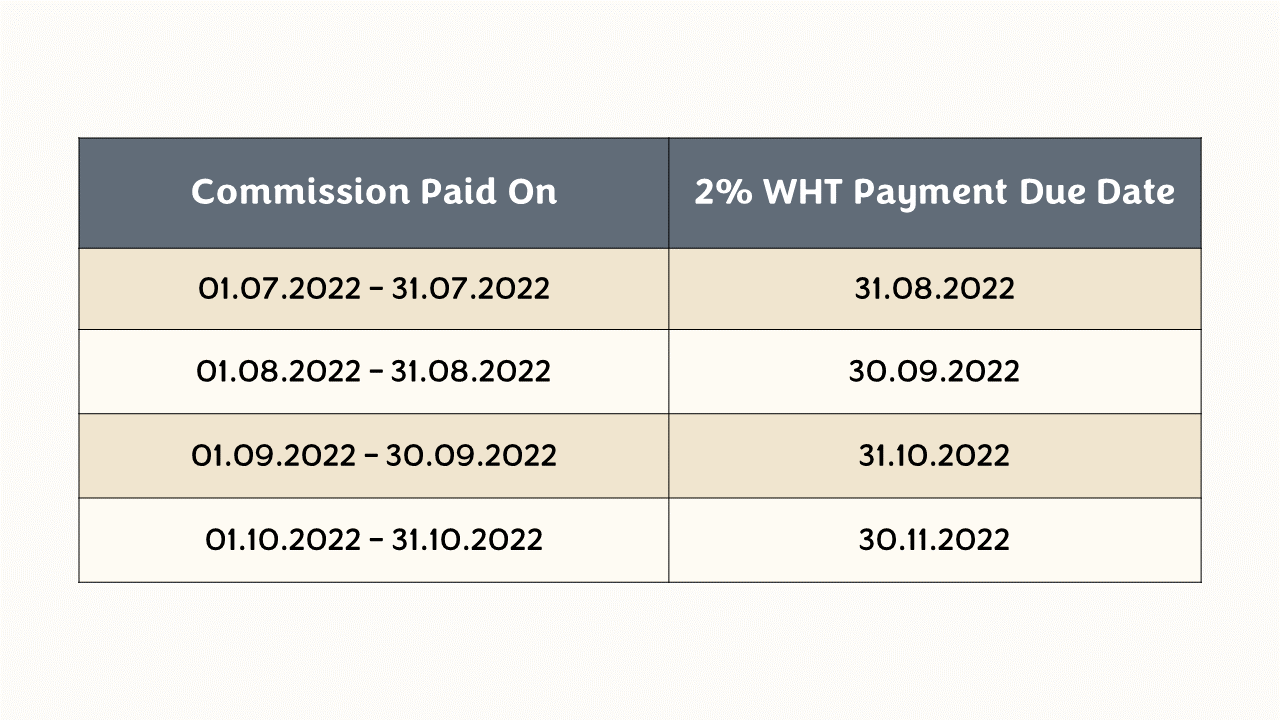

| 3. When does the company need to pay WHT?

|

- The 2% WHT must be remitted to the LHDN before the end of next month.

- For example, if the payment date is July 2022, the deadline for remittance to LHDN is 31.08.2022.

|

|

|

|

| 4. How is the deferred payment implemented?

|

| During deferment period (01.01.2022 – 02.03.2022), the companies are allowed to pay the withholding tax latest by 01.04.2022. details:

|

|

|

- WHT deducted during 01.01.2022 – 02.03.2022 shall be remitted before 01.04.2022.

- WHT deducted after 03.03.2022 shall be remitted within 30 days after paying the commission to agents.

|

|

|

| 5. Does the company need to do any declaration?

|

| Company needs to make a declaration before payment made via CP107D & Appendix CP107D (2) (each appendix limits to 20 agents).

|

|

|

| Email address of LHDN branches:

|

|

|

|

|

| Kindly take note:

|

- The company needs to submit declaration for all eligible agents.

- Both Forms have been updated in July 2022!

- Both Forms have to be e-mailed to related branches before payment made

- Only e-mail to the branch that you will make payment to

|

|

|

| 6. What is the payment method of WHT?

|

Payment can be made by postage or at the LHDN service counters together with the copy of CP107D & CP107D (2).

(Counter available for WHT payment: LHDN Kuala Lumpur, LHDN Kuching, LHDN Kota Kinabalu)

|

|

|

| 7. Do agents need to have an income tax number?

|

| Yes. If they do not have an income tax number, they can register through e-Daftar.

|

|

|

| 8. Does the company need to declare 2% WHT in CP 58?

|

| Yes. The updated CP 58 will allow companies to declare WHT.

|

|

|

| 9. Does this 2% WHT still apply if agents submitted Form CP500?

|

| Yes

|

|

|

| 10. If commission of Dec 2021 is made in Jan 2022, is it eligible for WHT?

|

- Commission received in Jan 2022 will be declared in CP 58 2022.

- If the total commissions amount in 2021 exceeds RM100k, a 2% tax reduction will be required in 2022.

|

|

|

| 11. Consequences of failure in remitting WHT:

|

- If the company fails to remit the 2% withholding tax to LHDN within the time given, late payment penalties (10% of the unpaid tax) will be imposed.

- The company’s expenses are not allowed to be tax deductible.

|

|

|

|

| Contact us if you have any problems!

|

|

|